February 9, 2022: We have completed the updates for the Tax Year 2021 Form 990, 990-EZ and Form 8868 (request for extension) forms.

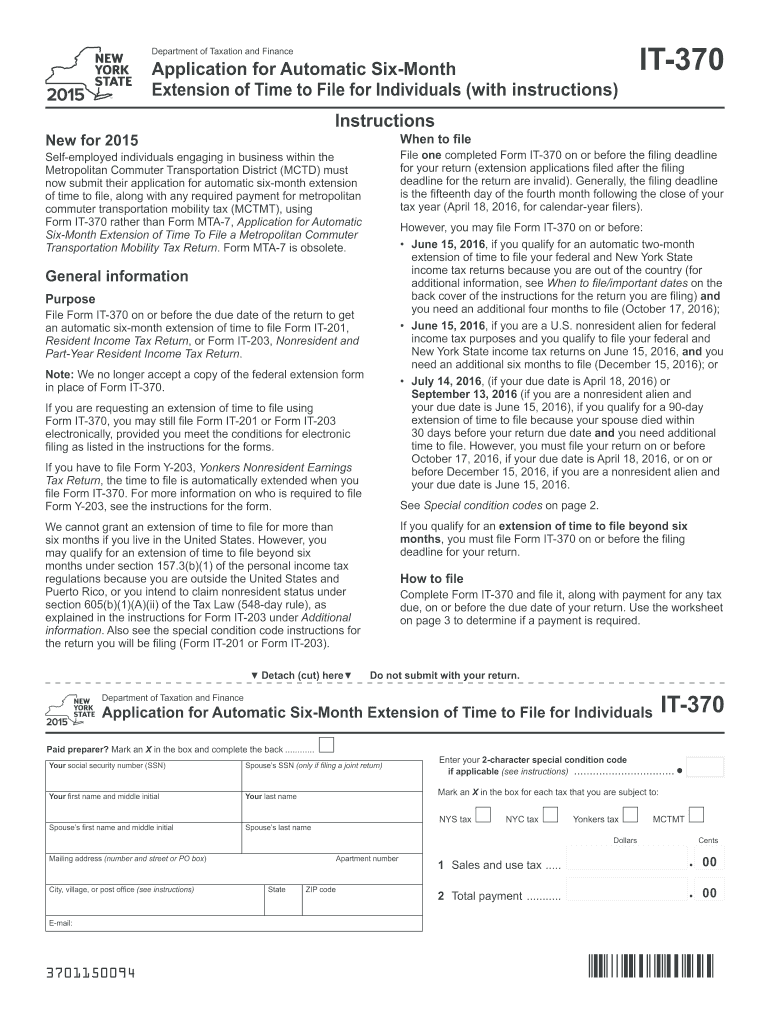

You pay any State fees you may owe directly to the State after you have completed the process. The IRS will not ask you why you need an extension period.

Irs 2016 extension form online software#

You can file your extension online with the help of tax software or with the help of an IRS authorized e-filing company.

Irs 2016 extension form online free#

Next, enter any taxes you’ve already paid, like taxes taken from your paychecks. After you’ve gathered your personal information, provide an estimate of your income by using last year as a guide. The Community Platform gives communities and universities the ability to map, visualize and take action to address the gaps between community needs and resources. If you need to file an extension for individual taxes, start by locating IRS Form 4868, which you can find on the IRS website.The DC Tutoring & Mentoring Initiative works to get a tutor or mentor for the 60,000+ students in DC reading below grade level or with other academic or non-academic needs.Form 990 Online is a program of the Civic Leadership Project, a nonprofit organization dedicated to strengthening the capacity of communities, and especially their nonprofit organizations, to address the social and economic challenges we face.

0 kommentar(er)

0 kommentar(er)